Populism, nationalism, trade wars, March for Our Lives, and the #MeToo movements, among others, are reshaping how people, governments and nonprofits respond and interact with companies, and with each other. In a recent speech to corporate citizenship professionals in New Orleans, I painted a picture of how our crazy world is impacting our roles as corporate philanthropists and responsibility practitioners, as internal and external stakeholders put more pressure on us to show value.

Populism, nationalism, trade wars, March for Our Lives, and the #MeToo movements, among others, are reshaping how people, governments and nonprofits respond and interact with companies, and with each other. In a recent speech to corporate citizenship professionals in New Orleans, I painted a picture of how our crazy world is impacting our roles as corporate philanthropists and responsibility practitioners, as internal and external stakeholders put more pressure on us to show value.

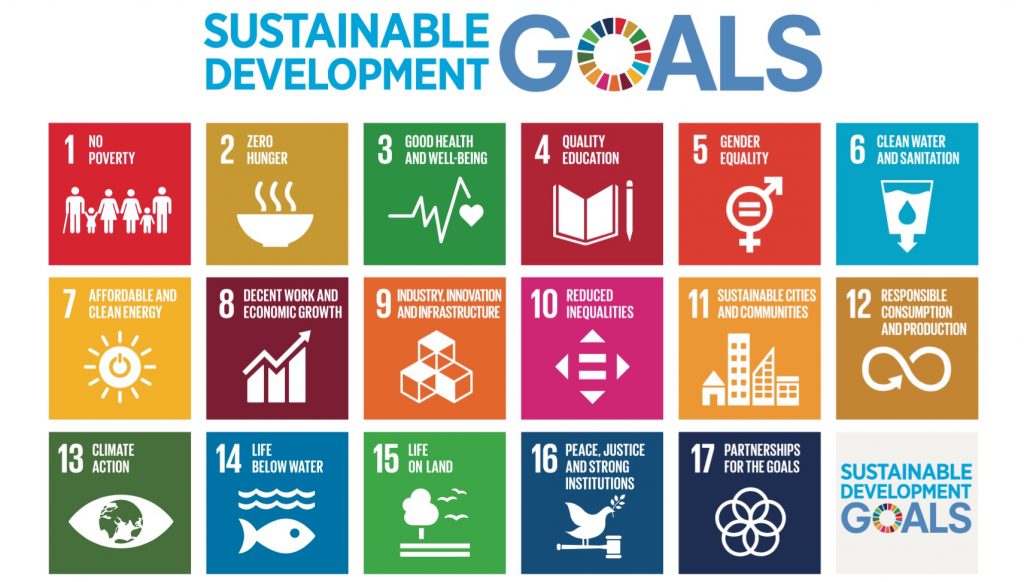

With company performance no longer being based on just financial reports and stock price, the craziness around us can be an opportunity to better position CSR as a partner to the C-Suite to help navigate these externalities and anticipate responses when we know situations are on the horizon. Companies have an opportunity to create stronger outcomes targeting some of humanity’s most challenging issues.

How a company interacts with society impacts areas like talent acquisition, employee engagement, product development, customer affinity and investor relations. Employees want purpose in both life and work. Customers and employees expect the values of companies to align with theirs, often pressuring companies to take a stand. Stakeholder engagement has moved beyond working with groups we want to inform to engaging those we need to inform. Whereas companies used to stay away from controversial issues, over the last two years we are increasingly seeing companies, often led by the CEO, engaging on issues that don’t necessarily have a direct impact on the business.

It’s not just about public positions. Issues such as the #MeToo movement have triggered additional funding for shelters and services for battered and abused women. While these types of organizations might not have been previously part of a company’s giving focus, corporate philanthropists are looking more broadly to impact issues that are currently in the spotlight.

Eroding trust

Populism, and other factors, has eroded trust in “the establishment” and with it business (corporate bashing has become common). But businesses produce and sell the goods and services people need and want, while creating jobs that provide income, injecting money into the economy for others to have the same opportunities.

Of course, some people have been left behind by this system and the widening income gap is problematic. Businesses are not perfect, and there is a history of some that have not operated with integrity. But most businesses are good and those working in the corporate philanthropy area have an obligation to demonstrate that through our companies’ actions and directly through our social purpose, financial and in-kind contributions, and employee engagement.

While these are challenging times, I look at it as an opportunity to step up our game by seriously taking a look at the impact our initiatives are making, and using new tools, such as The Conference Board’s benchmarking project with Mission Measurement, to help us make better decisions about what programs are most effective in achieving results.

While it seems like we wake up every morning to a new obstacle, we as a field have a unique responsibility to help our companies navigate and focus on what counts so we can create value for the business and society.

Originally published by The Conference Board on August 15, 2018.